And I want them to use it for all their strategy. Slather it everywhere! Make all your vision product strategy auto-generated from auto-polled sources like auto-summarized customer feedback. Because my competitors are all going to get terrible advice from current tools, and in aggregate, it’s even worse for them.

I’d rather they be wrong without wasting that energy and the other ethical concerns, sure. But I’ll take them being wrong as a start.

LLMs today tell everyone to do the same things, and better yet for me, that thing is to drive your car right into the nearest other car, and then see if there’s a wall handy.

“Blue Ocean Strategy” is the most useful way I can think of to explain why their advice is terrible. Blue Ocean Strategy says “pursue differentiation”: find products and services you can offer that your competitors can’t or won’t. This is contrasted against “Red Ocean” markets, where everyone’s viciously competing and tearing each other apart, spending much to little or no gain.

In good product management, with rare exception, you want to find opportunities where you can win by means other than being able to spend 10x on marketing (and even then, you’d rather not have to do that). To get there, you’re considering what your strengths are, what you have on hand, what you can do with it, how much time you have, what you know about the industry, your competitors, your product, and pairing that with learning everything you can about your customers. so you can find customer problems you can solve in a way that help them and make for a sustainable business. If you do that, you will find customer problems you can solve as a sustainable business, and they’ll be unique to you.

For instance, my current company, Sila Money, was originally a developer-first payment services platform on the Ethereum blockchain, with its own stablecoin, and moved money in and out via bank transfers. We don’t do anything with cryptocurrency today, but that history made the platform good at orchestration and business logic for moving money, we can add new partners and services very quickly, and we have APIs our customers appreciate. On the other hand, we don’t have full banking-as-a-service or card offerings, or UX our customers can plug into their applications, and we’re tiny, with limited engineering capacity to build things.

Then in the world of payments, the US has two relatively new instant bank rails, neither with full adoption, and a slower, kludgier bank payment system in ACH that is universally adopted, and also debit and credit cards, wire payments — it’s a lot. For companies who don’t want to build their own “try this payment method, than this other, than this other” stack, or just want someone else to deal with issues like ledgering across multiple partners and headaches like “this bank reports that they accept this payment method, but actually it always times out, so don’t attempt that” we built a great “call us once and we’ll figure it out, including automated failing over and everything” and have the flexibility to build out “try this, then this, then this” for specific use cases.

Our strengths led us to that product-market fit, and it’s taken off for us. Someone without the same advantages wouldn’t have done as well. If you were a close competitor to us a year ago, you might have had a much harder time building it on your technology, with your team, and you likely didn’t have the same customer base that would have bought it. Instead, if you followed a similar process, you’d have built products we couldn’t have, we’re both in better positions, and not as competitive with each other. I’d be recommending you in conversations for that use case.

The opposite approach product management for us would be to try and build an exact copy of a huge successful existing business. Person to person payments are huge, why don’t we get into that market, go up against Paypal’s Venmo. They do hundreds of billions of dollars in transactions, they’re valued at ~$70b as a company, and that’s just one of the companies in the space, look at all the money to be made! Why all we need is 1% of the total addressable market and we’re a unicorn startup!

To get that to succeed you have to catch up to their product, which is a huge investment, you need to give people a reason to use your knock-off, which is going to require marketing and incentives, you need partners who will also need tons of money… you essentially need to have the banking of a multi-national company willing to sustain colossal losses for the foreseeable future without faltering. Attempting this as anything less would be the end of your company, and likely very quickly. Don’t do this.

LLMs tell me, and my competitors, that that’s a great idea.

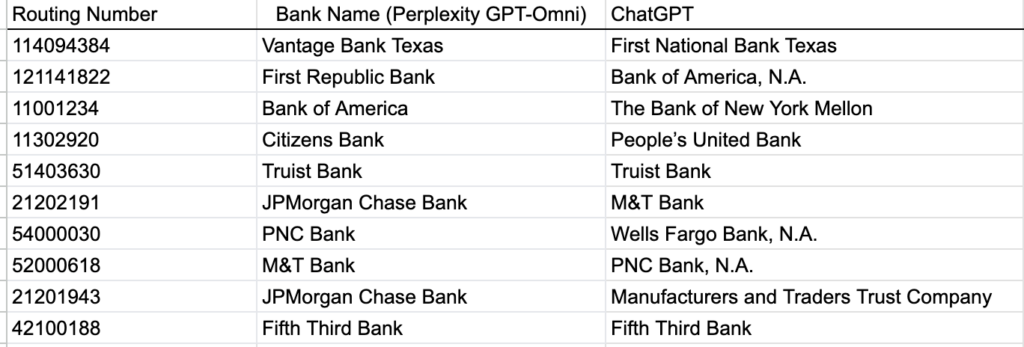

I asked different LLM tools (Claude 4.0 Sonnet, ChatGPT 4.1, Gemini 2.5 Pro 06-05) to set a product strategy, using a couple different prompts[1], and they all told me I should ram the company into the largest, nearest competitor, often followed by ramming the company into the second-largest competitor afterwards. Which if you think of LLMs as most-probable-next-word prediction engines gone nuts, makes sense: those are the use cases with the most money and adoption behind them, they get written about the most.

Ignoring the frequent suggestions to do things we already do, they told me:

- Embedded finance

- Become a vertical provider

- Get into stablecoins and digital assets. Tokenize all things!

- AI-driven financial services (automation/payments/compliance/etc)

- Build a superapp!

There were also themes in potential customers they mentioned – the “vertical provider” strategies would almost always mention focusing on the gig economy, for instance.

Let’s talk about getting into “embedded finance” for instance. Stripe has, in my opinion, the best zero-to-taking-money experience in the industry, from introduction docs and signup to how easy they make it to put payments on your site and then build it out. They’re so, so good, and it’s built on years on years of often unglamorous, unseen work by smart people grinding it out. There are things they don’t do as well, or have chosen not to go after, where there are opportunities, but in general? Catching up to Stripe is a crazy idea.

And that’s just one of the established, competent players who already have market traction.

Similarly, stablecoins are hot again, and the players in the space are newer, but whatever you’re looking for, there are a lot of more-established, smarter players in those spaces. Circle, for instance, has about 200 people and a US-dollar stablecoin with wide adoption ($60+ billion in circulation as I write this).

The superapp thing… ChatGPT 4.1 said my strategy here should be:

Unified Financial Operating System: Build a “superapp” or platform that consolidates payments, digital wallets, lending, compliance, and analytics into a single, customizable environment for fintechs and non-fintechs alike

And Gemini 2.5 Pro said:

This strategy capitalizes on the global superapp trend, which is reshaping consumer expectations. Many companies want to offer an integrated experience but lack the resources to build one from scratch. Sila could provide the foundation.

Where do you even start with that? Super-app answers seemed to be inspired by the same post every time it came up, which led me to a “how are these being drawn? Is this something with Perplexity?” (is it? Please let me know)

I’m discarding here the “go build something you have” advice, which I speculate is because the models didn’t have an up-to-date picture of the company. I checked on sources the models cited and found them often out-of-date, or confused[2]. That’s a separate issue, and “how do I update the big LLMs on my business” is something almost everyone’s trying to figure out.

I stopped here: the models seemed to want my company to do what everyone else was doing, or was about to start doing, and thus compete with established players who were already there and would crush us. This included when I tried to refine answers or use prompting to attempt to spur differentiation (which makes sense, it doesn’t know what they’re pursuing, but even when I’d add ‘I believe our competitors are doing x, y, and z, and I’d like to adapt to avoid competing on these things’ I’d get back the same “Vertical Specialization” strategy to “package your APIs into playbooks for underserved verticals (e.g., real estate, healthcare, creator economy)…”)

Before I threw my hands up, though, I wanted to see what strategic advice other players in the space would get given the same high-level prompts, and it was… the same.

Banking as a service company with a banking charter (excerpt from Claude)

- “AI-First Banking Infrastructure”

- “Target verticals underserved by generic banking APIs (e.g., healthcare payments, real estate, gig economy, B2B SaaS).”

- “Full-Service Platform: Launch a “bank-in-a-box” for startups—bundling compliance, KYC/AML, payments, lending, and analytics.”

(and here I’d say “they do that last one already”)

Adjacent not-direct-competitor, not a bank (excerpts from Gemni answer)

- “Vertical-specific Specialization” (insurance, gig economy, brokerage and wealth management, Vertical SaaS)

- Focus on developer experience

- A super-app pitch (“Shift focus from selling the API to selling a complete SaaS solution that is powered by the _ API.” )

- The “Embedded Finance” Enabler

Different not-direct-competitor (excerpts from ChatGPT)

- “Deepen focus on Embedded Finance”

- “Leverage AI and data-driven services”

- “Expand into New Geographies and Segments” (What! A unique one!)

- And then suggested some radical pivots, like “Vertical SaaS + Payments”, “offer compliance, banking, lending, and insurance APIs as a unified platform” and — Blockchain and Stablecoins!

Payments processing company (excerpts from Gemini)…

- “Dominate a vertical market” … “Shift from a horizontal platform serving all business types to becoming the undisputed payment infrastructure leader for a single complex industry. Potential verticals include B2B SaaS, healthcare, insurance, or creator economy platforms.”

- Cited a payments product they’d launched and then burned a lot of words on “make it the leading product” without (to my eyes) any real advice that wouldn’t have occurred to them in thinking about the product and then launching it

Few of them even noted when a company enjoyed a particularly strong position — when I saw an answer say something like “you just raised a ton of money, use that to your competitive advantage by investing in product offerings” I was surprised.

I love this for them! If you’re in an industry where suddenly all your competitors are hyper-focused on the same three vertical markets, spending ever-increasing amounts on customer acquisition and launching similar products into a crowded market (and then copying each other’s incremental improvements) wouldn’t you be absolutely delighted? The rest of the field is yours. Listen to your customers. Experiment with interesting products. Spend time mining data for insights.

Watch them crash their burning bumper cars into each other over and over, waving their last dollar at the attendant to let them have another minute driving. Cook s’mores on the barrel fire of their marketing budgets!

Now you’re thinking there is some interesting utility here, in that as consensus-regurgitators, the LLMs are giving an interesting insight into what we might say is the default strategy. It’s almost certainly what a crew of consultants is going to initially present their leadership team. You in turn would want to view any product strategy that took you in that direction as likely to be into greater competition and diminished returns – a signal to look for other options.

And you could then take a minute to think “if I was in my competitor’s position, how would I view this advice? Would any of it be tempting? What would I immediately discard?” as a useful thought experiment that might give you an idea of where they’re being pulled by the gravity of consensus. But you is that answer better than just thinking that through, starting with your own knowledge? Could thinking it through spark ideas of your own?

As I have through this series of experiments, I wonder at the gap from the claims of how company C-suite executives need to be all-in on AI in their work and the best are leading the charge, and how when I put it through its paces, these are the results I get for these most important decisions at that level. It’s hard to catch up on LinkedIn and not believe that there’s magic, if only you do the right incantations in the right place with the right components.

For now, though, “AI strategy for all of thee, but not for me.”

(Hey, if you dug this, please let me know, and share it to others! I’d appreciate the feedback and help)

Some open questions:

- I’ve been using Perplexity for ease of generating these from different models. Is that also introducing issues? The “super-app” thing from different models has me furrowing my brow, but in the past when I’ve also generated the answers directly from the model’s purveyors, they’ve matched reasonably closely to what I’ve gotten with calling that model via Perplexity

- Is there a way to give enough context and instruction that makes this exercise go well? Are there different approaches to the prompt itself, or setting this up, that help?

[1] The one I used across all companies and prompts was “I’m the incoming Head of Product for (Company Name) at (company URL), and I know that the current product strategy is not working. Based on what you know about the company and the industry, what are some potential strategies we might change to, and I’m open to complete pivots.” I also tried omitting the “current product strategy is not working” which I’d hoped would set up a fresh slate, and got essentially the same answers.

[2] There are several companies that share our name, which the LLMs all seem to trip over. There’s a much larger battery company also named Sila, for instance, so some sources think we have 40 patents around that, or that we raised $375 million in a Series G round, and that percolates up the the LLMs